About us

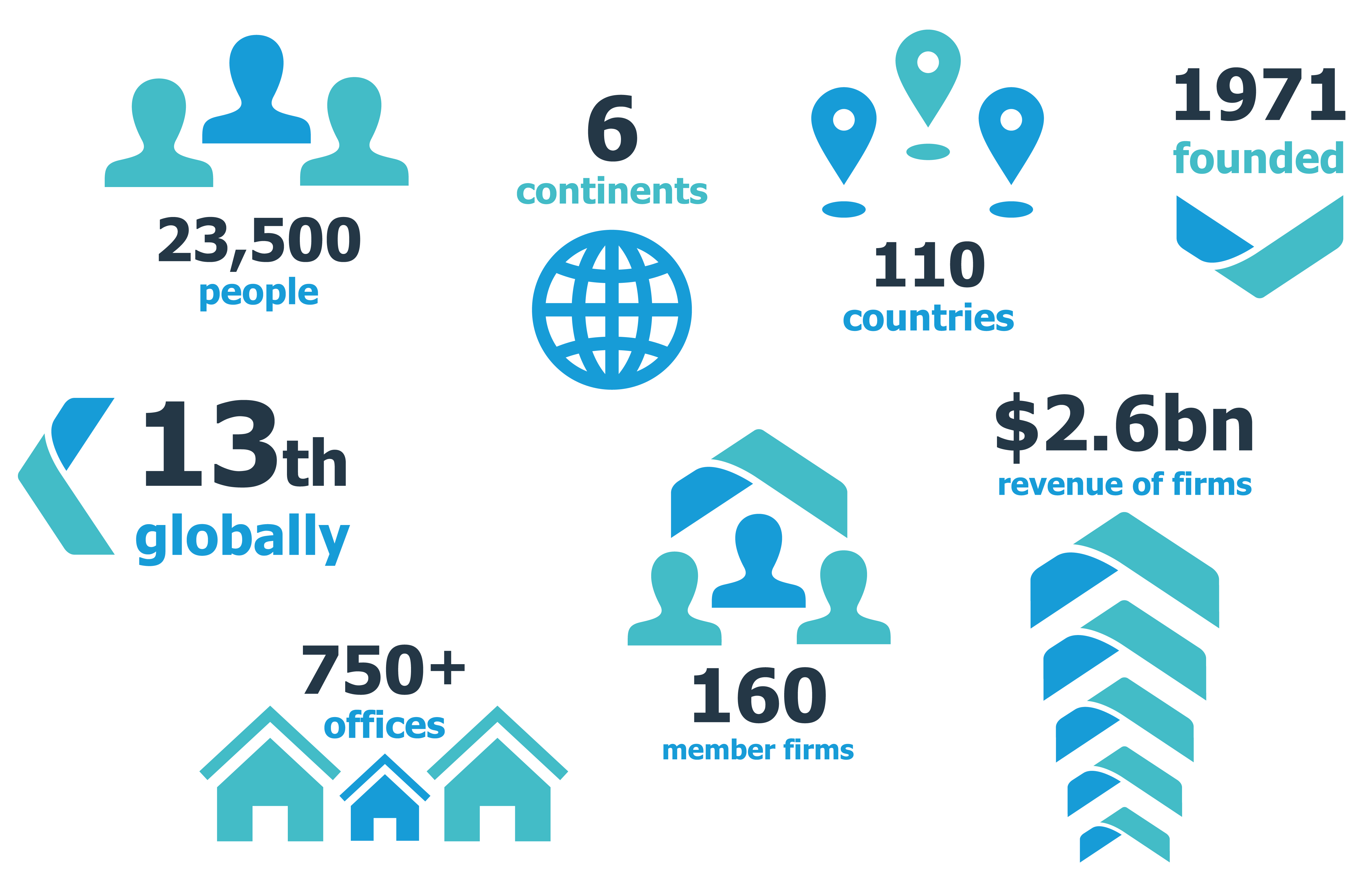

Kreston Bishkek is a member of the British audit network Kreston International. We provide the same

quality standard in more than 110 countries around the world. Our network is ranked 12th in the

world in terms of revenue (more than $ 2 billion a year) with a total number of employees of over

23,000 people. In Kyrgyzstan, we have been present since 2012.

Our partners are members of the British Association of Chartered Certified Public Accountants

(ACCA), and employees receive regular training approved by this Association (ACCA approved

employer). Also, our auditors have qualification certificates of the Kyrgyz Republic and the

Republic of Kazakhstan, certificates of IT auditors, etc.

The key staff has significant experience of effective work in Kyrgyzstan and abroad, including in

leading positions. In the process of selecting our employees, we pay special attention to high

analytical skills and the ability to provide excellent results to our clients. For a number of large

and highly specialized projects, specialists from other offices of Kreston are involved, including

from the head office in London.

A distinctive feature of our work is an in-depth analysis and a certified methodology for finding

problems in the internal control of clients. We are convinced that a well-established system of

internal controls enables organizations to operate and grow better and faster.

Services

Among our advantages are recognition of the global brand and emphasis on high quality services in the Kreston network . Our network is represented in more than 100 countries of the world with revenues of more than 2 billion US dollars. At present, we are No. 8 in the global ranking of audit companies by revenue (excluding Big Four companies).

HIGH QUALIFICATION OF SPECIALISTS

All partners (project managers) are certified and are members of the British Association of Certified Chartered Accountants. Employees undergo the necessary training and provide auditing with minimal distraction of accounting from its daily work.

CARE FOR OUR CLIENTS

Our audit is conducted with special care. Having discovered discrepancies, we analyze the underlying causes of their occurrence and provide the most optimal recommendation. Care for our customers and maximum satisfaction of their needs for the further development of business is the main priority for us.

Our services

Interestingly, the word audit came from the Latin word audit - "listens". At the present

time, auditors have departed a little from the original meaning and rely mostly on

written evidence, although interviews and the process of communicating with people

certainly take a significant amount of our time.

In Kyrgyzstan, we provide the following types of audit and related services:

- Audit of financial statements

- Tax audit

- Audit fraud

- Due diligence (analysis and assessment of the economic activity of the enterprise)

- Maintenance of access to international capital markets

- Audit of Islamic financial institutions in accordance with the Sharia

- Internal audit

- Other agreed procedures

Reviews

The most important goal of our work is customer satisfaction with the quality of the services provided. Below are some of the feedback we receive

Hermann-Gmeiner-Fonds Deutschland e.V., Finanzcontrolling private Förderer, i.A. Johannes Rist

"Your audit report is one of the best examples of audit projects. I would like all project audits to be like yours."

Judy Weishar

"Thank you very much for all your work. I appreciate your responsiveness and quick work."

CFO Celsius Coal, Matthew O'Cain.

"It was a pleasure to work with you in Bishkek. The firm has shown a level of professionalism and ethical behavior that really distinguish the audit process of our companies. I will certainly recommend you to my colleagues who work in this region."

About Kyrgyzstan

| Capital city | Bishkek |

| Form of governance | Presidential |

| Population | 7 mln. |

| Languages | Kyrgyz, Russian |

| Area | 199.9 sq.km. |

| Time zone | UTC+6 |

| Currency | Kyrgyz Som (KGS) |

Taxation- General Information

| Responsible authority | State Tax Service of the Kyrgyz Republic |

| # | Main taxes: | Rate | Tax base |

|---|---|---|---|

| 1 | Value added tax (VAT) | 12% | Imported goods and services cost/internally supplied goods and services cost. Applies to legal entities. |

| 2 | Corporate income tax | 10% | Profits (taxable income minus deductible expenses). Applies to legal entities. |

| 3 | Sales tax | From 0% (VATable transaction and paid through bank) to 5% (for mobile services) | Revenues. Applies to legal entities. |

| # | Salary and personal income taxes | Rate | Tax base |

|---|---|---|---|

| 1 | Social Fund contributions | 17,25% | Salary amounts paid. Applies to legal entities. |

| 2 | Social Fund contributions | 10% | Salary amounts paid. Applies to individuals. |

| 3 | Personal income tax | 10% | Revenues and salary. Applies to individuals – tax-residents (individual must be present in Kyrgyzstan for at least 183 days over consecutive 12 months). |

| # | Subsoil use taxes | Rate | Tax base |

|---|---|---|---|

| 1 | Subsoil use license bonus | Depend on license type (exploration/production) and mineral type. | Volume of reserves. Applies to legal entities. |

| 2 | Subsoil use license royalty | 1%-12% | Revenue from sales of minerals. Applies to legal entities. |

| 3 | License withholding payment | Depend on number of years of license holding and type of mineral. | License area |

| # | Other taxes | Rate | Tax base |

|---|---|---|---|

| 1 | Excise tax | Depend on product type (alcohol, petroleum, tobacco etc.) | Volume of product. |

| 2 | Land tax | Depend on location and purpose of land | Land area. |

| 3 | Property tax | Depend on property type (real estate or automobile) | Property area or engine capacity. |

| 4 | Simplified tax system | 3% (revenues received through bank) or 6% | Revenues. Applies to legal entities whose income does not exceed not exceeding KGS 8 mln or around USD 116 thousand. |

| 5 | Patent | Specified amount paid monthly for certain activities (not exceeding KGS 8 mln or around USD 116 thousand). | Applies to individuals. |

| 6 | Non-resident tax | 5% for insurance premiums and international telecommunications and transportation services/10% for other activities | Revenues. Applies to both legal entities and individuals. |

Countries with agreements to avoid double taxation

- Austria

- Belarus

- Canada

- China

- Finland

- Germany

- India

- Iran

- Kazakhstan

- Korea

- Latvia

- Lithuania

- Moldova

- Mongolia

- Poland

- Pakistan

- Russia

- Switzerland

- Tajikistan

- Ukraine

- United Kingdom

- Uzbekistan

Business entities

| Open joint stock company | Free trading of shares. Share capital should not be less than 100 thousand KGS. |

| Closed joint stock company | Number of shareholders should not exceed 50. Share capital should not be less than 100 thousand KGS. |

| Limited Liability Company | Liability of the owners is limited by the amount of capital. Registration process is relatively simple and is finalized within 10-20 days. |

| Branch | Established for representative purposes. Branch may perform part or all of the legal entity’s functions. |

| Bank | Shareholder’s capital of 1000 mln KGS. Must be audited. |

| Microcredit company | Shareholder’s capital of 50 mln KGS. Must be audited. |

Other regulation

| Accounting framework | International Financial Reporting Standards |

| Auditing framework | International Standards on Auditing |

| Currency regulation | Free floating exchange rates |

| Foreign investment | Legislation provides for non-expropriation and protection from nationalization, free repatriation of funds, freedom of monetary transactions, and access to international arbitration. |

| Foreign employees | Regulated by quotas determined by the Government of Kyrgyzstan |

| Labor regulation | Employee termination should be performed with up to 2 months’ compensation. |

| Tax regimes | Free economic zones are set in areas near Bishkek and remote area of the country. These zones provide for exemption from imports customs duties and taxes on imported goods (unless goods are sold in Kyrgyzstan). |

You can download the above information in file Investment and tax guide.